Medicare Part D is Medicare’s prescription drug benefit that provides outpatient drug coverage. Part D is offered through private insurance companies that have contracted with the federal Medicare program. You can secure Part D coverage through a stand-alone plan or get it bundled into a Medicare Advantage (Part C) plan.

Why You Need Medicare Part D

The Medicare program consists of four parts: Parts A, B, C, and D. Parts A and B make up what we refer to as Original Medicare. Original Medicare covers inpatient and outpatient medical costs, including some intravenous prescription medications. However, it does not cover any prescriptions that you’d typically get through your pharmacy.

Part C is Medicare Advantage. Medicare Advantage plans require some extensive education, but for now, just know that every Medicare Advantage plan is different. Some Part C plans include prescription drug coverage. Those plans are referred to as MAPD plans. If you have prescription drug coverage in your Medicare Advantage plan, you do not need a separate Part D plan.

If you do not enroll in an MAPD plan, the only way to get prescription drug coverage is through a separate Part D plan. A Part D plan will help cover the prescriptions you get at your pharmacy. The only time we don’t recommend prescription coverage is if you have prescription benefits through VA Healthcare of TRICARE for Life.

Even if you are not currently taking any prescriptions, it’s important to enroll in a Part D plan as soon as you are eligible. This is important for two reasons. First, you’ll avoid the Part D penalty, which we’ll discuss next. Second, you can’t enroll in a Part D plan whenever you want. If you do not enroll when you’re first eligible, you’ll have to wait until the Annual Election Period (AEP) and won’t have coverage until the start of the following year.

Medicare Part D Penalty

Medicare has several penalties, but none are as common as the Part D penalty. As we hinted at earlier, many people make the mistake of not enrolling in a prescription plan if they aren’t taking any medications. The problem with this is that it causes you to pay penalties later.

If you go without prescription coverage for more than 63 days, you begin incurring a Part D penalty. Each month you don’t have coverage adds to that penalty. When you do decide to get a Part D plan, you’ll have to pay that penalty each month. The worst part? The penalty lasts for as long as you have a Part D plan. So, presumably, for the rest of your life.

How is the Part D penalty calculated? The Centers for Medicare and Medicaid are the only ones who can accurately calculate your penalty, but we can help you get pretty close. The penalty is calculated by taking the number of months you went without coverage multiplied by 1% of the national base beneficiary premium. This year (2023), that amount is $32.74. Let’s look at an example.

Jim went a full three years without a Part D plan, which equals 36 months. Jim’s penalty is calculated with the following equation:

36 x 1% x $32.74 = $11.80

The penalty isn’t the only thing Jim has to pay. He’ll also be responsible for the plan’s monthly premium, deductibles, and coinsurance or copayments. And keep in mind that the national base beneficiary premium usually increases each year, and so will his penalty. Jim pays this penalty every month for the rest of his life. Ouch!

What Drugs Are Covered Under Medicare Part D?

Prescription drug plans and Medicare Advantage Prescription Drug plans cover all vaccine drugs that are necessary to prevent illnesses. Outside of that requirement, each plan has a drug formulary that states which prescriptions are covered. For example, the type of insulin you use may be covered by one plan but not another.

All Part D plans are required to cover at least two drugs in every category, meaning for a particular condition or illness. Plus, they must cover all prescriptions available in the following categories:

- Antidepressants

- Anticonvulsive treatments

- Antipsychotics

- Anticancer drugs

- HIV/AIDS treatments

- Immunosuppressants

In addition to providing you with a list of covered medications, the formulary will also tell you which tier each drug falls into. Most plans have four or five tiers. Drugs that fall into lower tiers cost less than those that fall into higher tiers.

Before choosing a Part D plan, it’s important to gather a list of all your current medications and compare that list to the plans available in your area.

What Drugs Are Not Covered Under Medicare Part D?

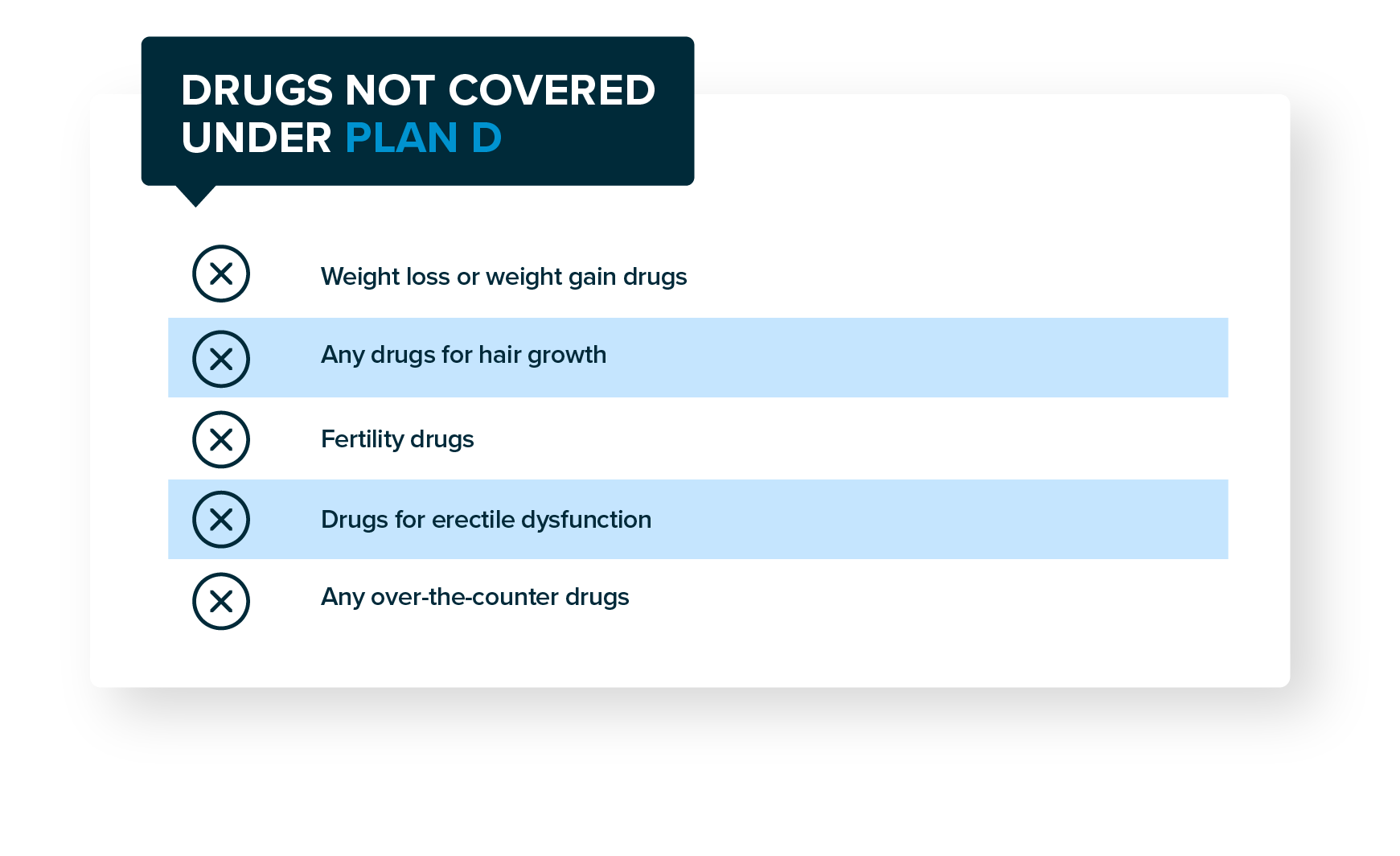

As we mentioned earlier, each Part D plan can have a different drug formulary. However, there are certain prescriptions that are almost never included in Part D or MAPD plans. These medications include those for:

- Weight loss or weight gain

- Hair growth

- Fertility

- Erectile dysfunction

Prescription plans do not cover over-the-counter medications like acetaminophen, ibuprofen, cough syrup, etc.

How to Choose a Medicare Part D Plan

Choosing a Part D plan is fairly straightforward, even if the plans are somewhat complicated to understand. The easiest way to enroll in Part D is with the help of an independent insurance agent, like the ones at Bobby Brock Insurance. You can also use Medicare’s Plan Finder Tool to look for plans in your area. We recommend using an agent instead to avoid any enrollment mistakes and so you have someone you can call if problems arise.

When we look for a Part D plan, we compare your current prescription list to all the drug formularies within your zip code. We also make sure we plug in your preferred pharmacy, as not all insurance carriers work with all pharmacies. This applies whether you’re purchasing a separate Part D plan or if you are enrolling in a Medicare Advantage plan with drug coverage.

We narrow down your selection by looking for all the plans that cover all your medications, or at least which plans cover most of them. Then, we find out which of those plans covers your drugs at the least out-of-pocket cost for you.

The best way to choose a Part D plan is by looking at your total cost for the year. This includes your premium and the costs to refill your prescriptions. The plan with the lowest total cost is the one you want!

Changing Your Part D Plan

What happens if your prescriptions change? After you enroll in a Part D plan, you have to keep it for the remainder of the year. (Unless you have a significant, life-changing event and qualify for a Special Enrollment Period.) It doesn’t mean that your new prescription won’t be covered. Hopefully, it’ll still be included in the drug formulary. If it isn’t, you may want to ask your doctor if there are alternatives.

You can change your Part D or MAPD plan during Medicare’s Annual Election Period. AEP begins on October 15 and runs through December 7. You can switch your plan during this time, and your new plan goes into effect on January 1.

It’s important to review your Part C or Part D plan during AEP, even if you’re happy with your current plan. Part C and Part D plans operate on annual contracts, meaning they can change their benefits each year. Your plan may make changes that you don’t like, so it’s important to take a few minutes to review them.

Every September, your current plans will send you an Annual Notice of Change (ANOC) that outlines what changes will be made to your plan. You can use this as a starting point to decide if you’d like to keep your plan or shop around for other options. We always recommend looking at other plans as insurance carriers are always trying to compete for your business by offering better benefits or lower costs.

If your plan does have changes, you will be notified. All plans are required to publish any changes to their formularies on the plan’s website. The insurance company must also tell you when drugs are removed from the formulary.

All plans are restricted from making changes to the drugs provided and making price changes between the beginning of AEP until 60 days after coverage begins. The only exception is if the Food and Drug Administration determines a drug is unsafe or if the manufacturer ceases production of the drug.

Also, any changes must include the name of the drugs removed, if the drug changes tiers, the reason for the change, alternative options, and available exceptions.

Enrolling in Medicare Part D

When you’re ready to enroll in Part D, call Bobby Brock Insurance. Our Medicare experts will work with you to determine which Medicare plans are important to you. We’ll make sure you have the coverage you need at a price you can afford.

Don’t try to navigate the Medicare maze on your own. Our services are completely free to you, and you won’t pay higher premiums just for using our services. Use Bobby Brock Insurance to enroll in Medicare today and have peace of mind for your future!

Your Rights to a Prescription Drug Plan

Once you purchase a prescription drug plan, you have the right to:

- Receive a written explanation from your plan about your benefits

- Ask for exceptions if a drug you need is not covered by your plan

- Ask for exceptions to waive coverage rules

- Ask for lower copayments for higher-cost drugs if you or your prescriber believe you can’t take lower-cost drugs for your condition