Medigap Plan B

Medigap Plan B offers similar benefits as Plan A but it also includes coverage of Original Medicare’s Part A hospital deductible.

Because Part A’s hospital deductible isn’t an annual deductible, you would be responsible for paying it multiple times throughout the year without a Medigap plan.

What does Medigap Plan B cover?

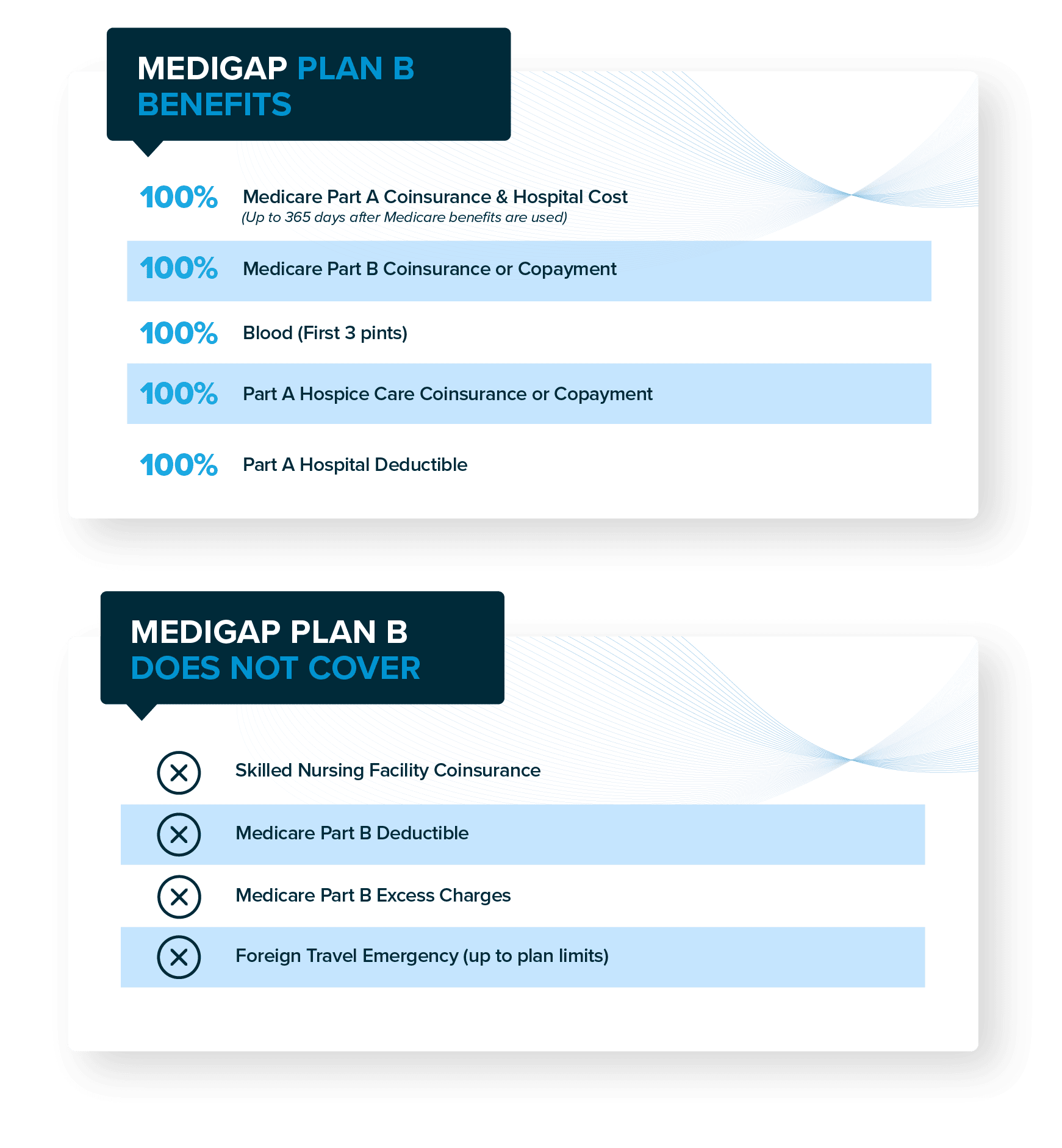

As previously stated, Medigap Plan B covers everything Medigap Plan A does plus your hospital deductible. This means it covers 100% of the costs associated with these four things:

- Medicare Part A coinsurance payments for inpatient hospital care for up to an additional 365 days after Medicare benefits are exhausted

- Medicare Part B copayment or coinsurance expenses

- The first three pints of blood used in a medical procedure

- Part A hospice care coinsurance expense or copayment

- Part A hospital deductible

That last point is an important addition as it could save you several extra thousand dollars if you have more than one hospital stay in a year. Ask a licensed Medicare agent at Bobby Brock Insurance how much you could save with a Medigap policy.

How do I enroll in Medicare Supplement Plan B?

You can enroll in any Medigap plan as soon as your Original Medicare Part B plan is in effect. Once you meet that requirement, you have six months to enroll in a Medicare Supplement Insurance plan with guaranteed issue.

However, you can enroll anytime. Outside of open enrollment, you only have to answer some simple health questions.

How much does Medigap Plan B cost?

Each insurance company that offers a Medigap plan will set their own premium based on the data in their area. This means your zip code, gender, age, tobacco usage, and other factors could affect the premium of your plan.

Because each carrier has to offer standardized coverage with each Medicare Supplement Insurance plan, you should choose a carrier that has low rates and a healthy rating. One of our licensed Medicare agents can easily supply you with that information. Just ask!