You’re getting blasted on TV about Medicare Supplements and Medicare Advantage. This year especially, there’s huge expansion in Medicare Advantage programs in many areas — including our area of Tupelo, MS.

Some people are talking about “Trump Care” and other words that are misleading. We want to clear things up.

Have You Seen the Ads and TV Commercials?

Chances are that you’ve seen a Joe Namath commercial where he says, “I called the Medicare Coverage Helpline and they instantly looked up my coverage.” They have been playing this commercial for the past few years, and we get many calls about it.

Have you seen the ad specials on Dr. Phil and Dr. Oz episodes that discuss Medicare Advantage? Do you know what exactly they’re talking about and why?

Well, they are being paid endorsements to talk about Medicare.

Not a One-Size-Fits-All Situation

We’re going to break down the pros and cons of Medicare Advantage programs vs. the pros and cons of Medicare with a Medigap plan or Medicare Supplement — which is what many of our customers have. I’m not going to push you in one direction or the other. I just want to break it down so that everyone has an unbiased look at this. It’s definitely not a one-size-fits-all approach!

There are some folks who can’t get one of these plans and the other one is clearly a better fit, and vise versa. There are also people who can’t afford premiums on one and need the other plan to protect them from out-of-pocket costs. But if you can afford a bit of premium, one plan might be better than the other. Let’s dive into it.

Medicare Advantage: Pros and Cons

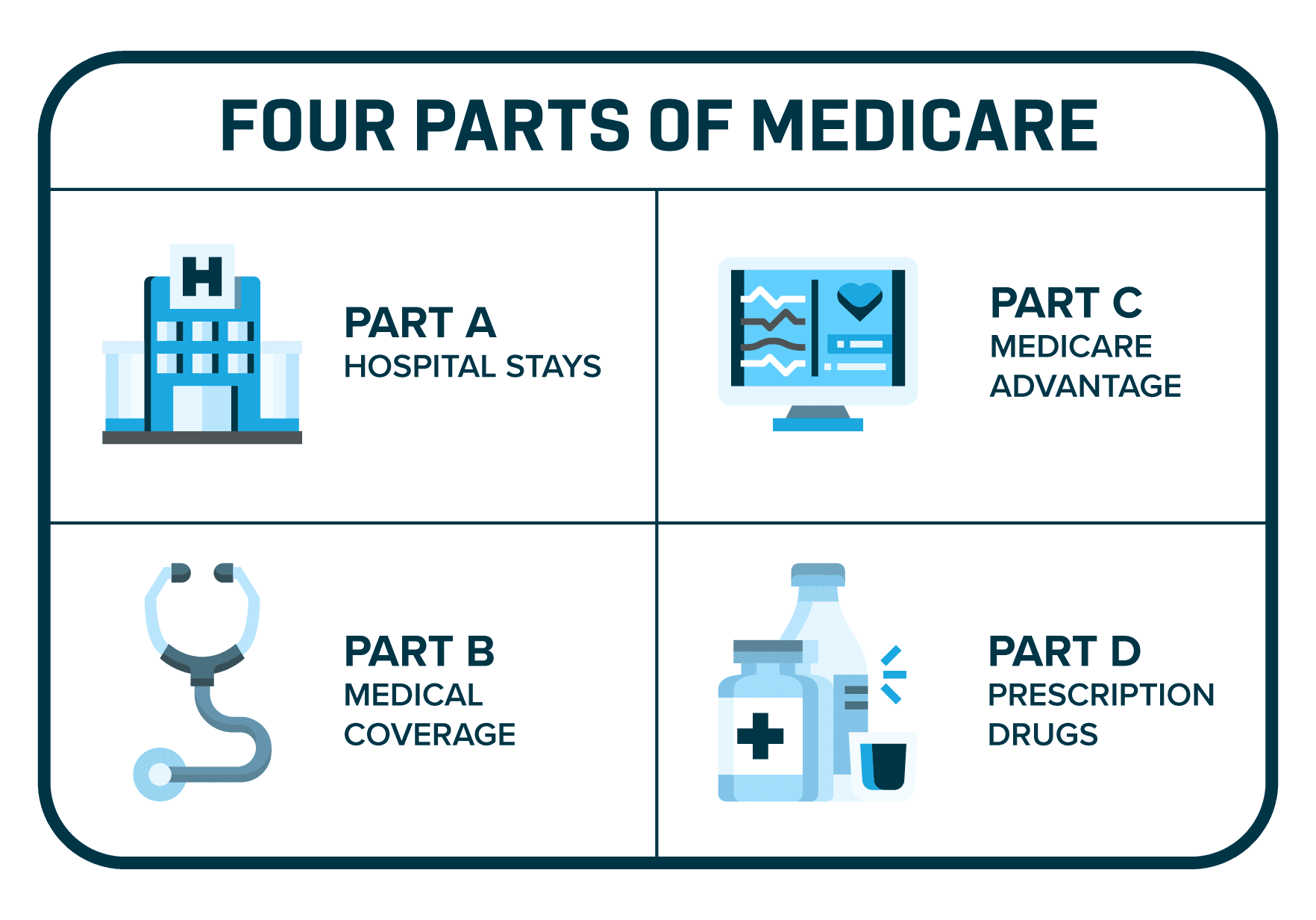

Medicare Advantage plans are a type of Medicare plan — offered by a private company — that provide all your Original Medicare benefits. Some Advantage plans offer additional benefits, such as dental, vision, hearing, and wellness programs. There can be a little bit of difference depending on which program you have.

Medicare Advantage programs have more pros than cons.

| Pros | Cons |

| $0 to low premium | Network limits |

| No health questions | Prior authorization |

| Caps on out-of-pocket — around $6,700 | Some copays can be high |

| Most include Part D coverage | |

| Low copays | |

| Stable rates |

The Pros Explained

Medicare Advantage is more cost-effective from the perspective of how much premium I’m paying out — whether you’re sick or not.

Prior to this fall, the only health question asked was: “Do you have end-stage renal disease?” But now, there won’t even be this question on the application.

Most Medicare Advantage plans include prescription drug coverage (Part D) at no additional cost. We also don’t see a lot of rate fluctuation on most of these plans nationwide.

The Cons Explained

Sometimes you have network limitations, which means sometimes you can’t go to your doctor or hospital, or you might have to change your doctor or hospital.

Another con is prior authorization. Sometimes your doctor wants to order a test, but he has to get authorization from the Medicare Advantage plan to order that test. This can be disruptive, and it’s a big deal for some folks.

Third, some daily hospital copays for a set number of days might be high. Outpatient surgery copays may be around $200 – $350, depending on the plan. These copays can really add up over time.

Medicare + Medigap: Pros and Cons

A Medigap plan is a Medicare Supplement, like Plans F, G, K, L, N, etc. These plans help “supplement” Original Medicare by paying for some of the remaining costs — like copays, coinsurance, and deductibles. There can be differences depending on which plan you have.

| Pros | Cons |

| Go to any provider accepting Medicare | Higher initial costs on premium — $100-$200 |

| Typically no prior authorization | Part D sold separately |

| Little to no out-of-pocket costs | Premiums increase more over time |

The Pros Explained

First, you can see any provider that is accepting Medicare — which is about 97% of doctors and hospitals nationwide right now. So, you see a massive acceptance rate for the Medicare plans.

Most of the time, Medicare approves any tests so you don’t have to go through prior authorization. Medigap is more seamless in that area than Medicare Advantage.

Another pro is little to no out-of-pocket. If you were eligible for Medicare before January 1, 2020, you could have a Plan F and have ZERO medical out-of-pocket expenses. If you have a Plan G, you could be limited to just $198 per calendar year — which is the Part B deductible. This deductible may increase next year, but it’s still a relatively small out-of-pocket cost.

Most people might say, “If I can get great coverage and pretty much go anywhere… sign me up!” However… we must address the cons.

The Cons Explained

The Medigap cons are related to the premium costs. The premiums are normally going to cost between $100 – $200 — which can increase over time. If you’re a female turning 65, your premium might be in the $90 range.

You also have to buy Medicare Part D separately when you go this route. Those plans can range from $13 – 20 to $80 per month (tacked onto the supplement cost) depending on what drugs you’re taking and what pharmacy you go to.

Plus, sometimes you have to answer health questions to lower your rate or get access to a policy. In other words, medical underwriting is involved on the Medicare Supplement side.

You can change your Medicare Supplement any time you want. You just have to answer health questions, which can get tougher for some people as they age — because they might take on more conditions.

It’s Hard to Decide on a Plan. So Work with Us

It’s very confusing to decide which plan is best for an individual. We must look at your particular circumstance, health, budget, needs, and expectations of your coverage.

It’s best to use a group — like the team at Bobby Brock Insurance — to examine all the plans and available options without bias. You can talk to any of our agents, and it doesn’t cost you anything!

We’re happy to help. We want to put you on a plan that we’d put our own parents, relatives, and friends on. Our clients are our friends, so give us a call today at 662-844-3300.

Related Blog Posts

-

If you are nearing retirement age, you may be wondering what your options are for health insurance. Once you've enrolled…

-

Introduction Healthcare is essential, especially as we get older. We are going to answer the big question, Medicare Supplements vs.…