Medicare Plan Comparison 2023

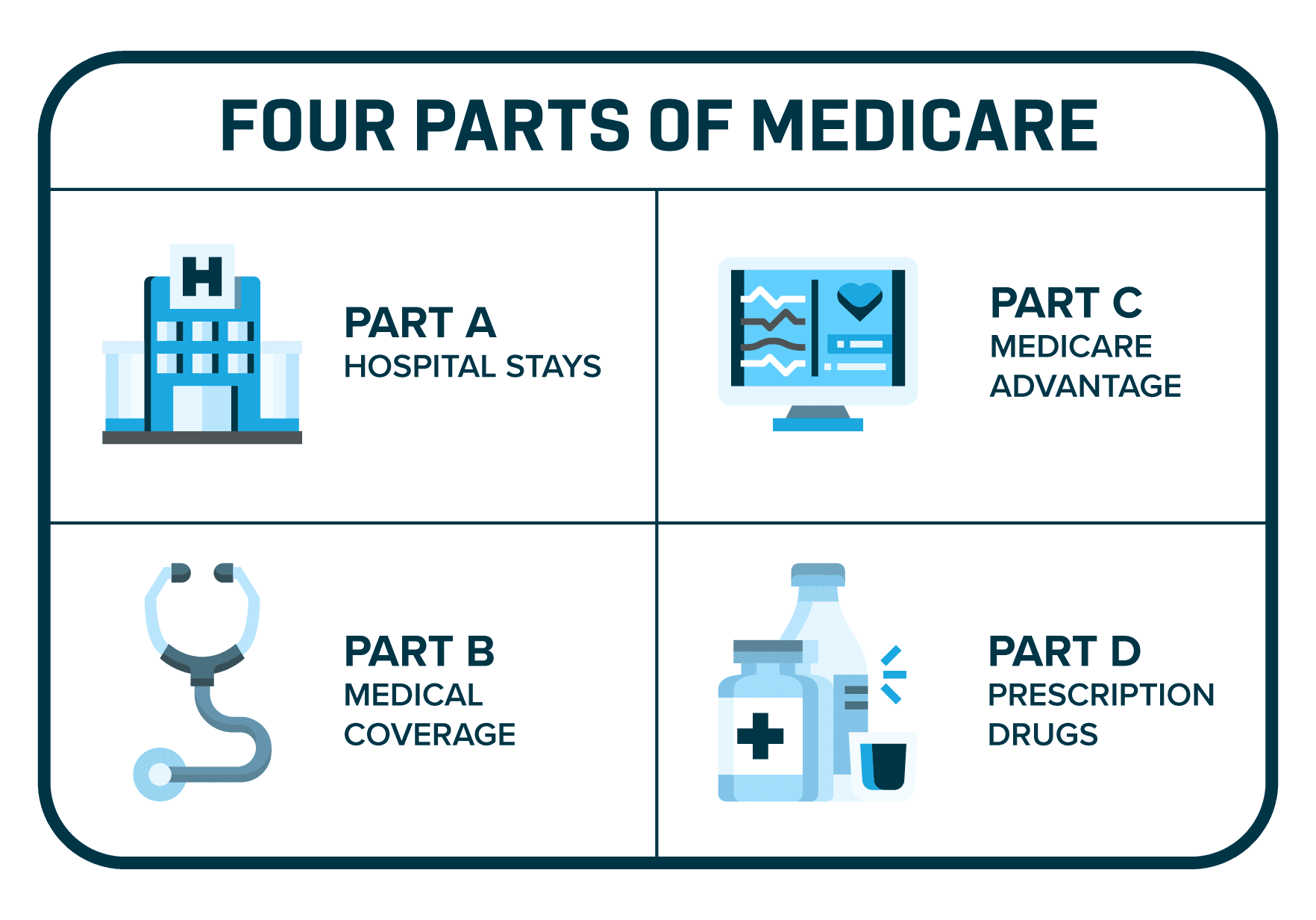

Medicare Plan Comparison in 2023 – Whether you are just about to enter Medicare, or have had the coverage for many years, selecting a private Medicare Insurance plan is a key decision that will directly impact your bottom line. Perhaps the most important skill that will enable you to make smart decisions when it comes to your coverage is the ability to compare Medicare plans. To give you some help with Medicare plan comparison 2023, read this short guide designed to help you compare plans with ease.

Why Do You Need To Compare Plans?

It might be helpful to briefly explain why plan comparison is necessary. You’ll need to perform this task in order to determine what kind of Medicare plan would be a good fit for you. You will likely choose private Medicare coverage in order to limit your out-of-pocket spending on medical care. As you probably know, there are a number of costs you’ll face when using Medicare coverage, like:

- Deductibles

- Co-insurance

- Excess charges

- Emergency care you receive outside the United States

Unfortunately, these costs are not capped in any way; there is no Out of Pocket Maximum limit like with other health insurance coverage. Because costs for medical care can add up precipitously, most people choose to utilize a private Medicare plan to limit their costs. There are two strategies available for using private coverage:

- A Medicare Supplement Plan plus a Part D prescription drug plan

- A Medicare Advantage Prescription Drug Plan (MAPD)

You have to choose between these options because you’re not allowed to combine them.

Deciding between these two strategies also requires you to do some comparisons. Once you choose a strategy you’ll then need to compare individual plans within your selected strategy. While the choice between Medicare Supplement and Medicare Advantage requires more consideration than just this, here is a brief review of who the different strategies might appeal to.

People who choose Medicare Supplement Insurance often prefer to avoid networks of physicians and referral requirements. They might travel frequently, including outside of the U.S. People who choose Medicare Supplement would generally rather pay more on a monthly basis and have fewer out-of-pocket costs for medical services.

On the other hand, people who choose Medicare Advantage often appreciate the availability of “extra benefits” like vision, hearing, dental, and gym memberships; these benefits aren’t available from Original Medicare or Medicare Supplement plans. People who select Medicare Advantage also generally prefer to pay less on a monthly basis (lower premium cost) in exchange for paying relatively small co-payments each time they receive medical care.

Once you’ve chosen your strategy for coverage, it’s time to get into the nitty gritty of Medicare Plan comparison.

How To Compare Medicare Advantage Plans

In some ways, comparing Medicare Advantage plans is harder work than comparing Medicare Supplement. This is because Medicare Advantage plans almost always come with some kind of provider network and prescription drug formulary; this complexity isn’t present in comparing Medicare Supplement Plans.

When you compare Medicare Advantage plans, you should use the following considerations:

- Are your doctors in the plan’s network?

- Are your medications covered by the plan (on the plan’s formulary)?

- Costs for coverage and services

- The extra benefits available

- Medicare STAR Ratings

- The strength of the plan’s provider network

Let’s review each of these in turn.

Are your Doctors In the Plan’s Network?

The single most important consideration is whether your doctors are in a plan’s network. As a general rule, you should prefer Medicare Advantage plans where your providers are in-network. You’ll want to see if not only your primary care physician is in the network, but any specialists you routinely see, too.

This is especially important if you’re considering an HMO plan. With an HMO, your plan likely won’t cover any costs you incur if you see an out-of-network provider. You can avoid this by simply comparing plans on the basis of which one has all, or most, of your providers in their network.

<h3>Are Your Medications Covered?</h3>

The next most important factor is to see which Medicare Advantage plans the best cover any medications you routinely take. You’ll want to look not only at whether they’re covered but also at how much they cost. With all other things being equal, you’d generally prefer a plan with lower out-of-pocket costs for your prescription medications.

Costs For Coverage And Services

The next most important element to compare plans on is cost. The costs you can compare include:

- Premiums

- Deductibles

- Out of Pocket Maximums

- Co-payment or co-insurance amounts for services and procedures

You’ll want to look not only at how much the premium is for coverage but also how much you might pay in co-payments based on your health care usage. Look closely at the cost of specialist visits, especially if you see these providers frequently.

Extra Benefits

When you’re comparing the extra benefits of two or more plans, you should keep in mind which ones you definitely need and are most likely to use. If one of the plans you’re investigating has rich extra benefits that aren’t relevant to you, don’t over-value them just because they’re rich. Consider only what you’re likely to use.

Medicare STAR Rating

CMS (the Centers for Medicare and Medicaid Services) provides a rating on every Medicare Advantage plan each year. If two plans suit you equally, you should review the STAR ratings to see how plan members rate each plan. Higher ratings generally mean more positive experiences for members.

Strength Of Network

If you’re comparing two or more plans, and all of your doctors are in-network for all of them, take a look beyond your current needs. You might want to give the edge to the plan that has a deeper or more extensive provider network. This would come into play if you’re referred to a new specialist for a condition you develop in the future. If you’ve chosen a plan with an extensive network, chances are you’ll have access to a large selection of specialists.

Making Your Choice

In many cases, only one plan in your area will have all of your doctors, specialists, and facilities in-network, which may very well make the choice for you. However, if more than one plan does, then you can continue down the priority list. Select the plan that most meets your coverage and budgetary needs.

How To Compare Medicare Supplement Plans

It’s easier to compare Medicare Supplement Plans, or Medigap Plans as they are often called, for the primary reason that their benefits are standardized. Once you know that you want Medigap coverage, you just need to determine which level of benefits best suits you. You can choose from 11 standardized Medigap Plans; Plans: A, B, C, D, F, High Deductible F, G, High Deductible G, K, L, M, and N.

Since each one of these Medigap plans covers a different mix of the costs of Medicare, it’s easy to find the one that fits your needs. To help you do this, consider asking yourself the following questions:

- Is international coverage important to me?

- Do I expect to consume a lot of medical services and procedures?

- What premium level can I comfortably afford?

When reviewing these questions, the international coverage question can be a real difference maker. If you like the idea of having Medicare coverage outside the U.S. you’ll need to consider Plans C, D, F, G, M, and N. Aside from the international coverage question, it really comes down to how much you’re willing to spend out of pocket. If you want to limit your out-of-pocket spending to the minimum, consider Plan G. If you’d rather pay a few costs out of pocket in return for lower monthly premiums, consider Plan N or Plan D.

Once you know which standardized Medigap plan you want, it’s time to determine which insurance company you want to use. Once again, comparison shopping will stand you in good stead here. Since the benefits are standardized across all insurance companies, you can make a selection based on these factors:

- Premium cost

- Years in your market

- Financial strength

- Reputation

Obviously, the cost is a major factor, and generally, you’ll want to pay as little as possible for your coverage. However, don’t let that be the sole factor you consider. Definitely pay attention to how long an insurance company has been in your local market. Companies with less experience in your area may be more likely to offer lower premiums up-front, but raise rates aggressively over time.

In the same way, you might want to prefer companies with strong financial ratings from rating agencies. S&P and AM Best offer ratings on insurance companies.

Lastly, consider the reputation of the two or three companies you’re considering. If you feel like one is perceived better by their policyholders, consider favoring them for your own coverage. If you’re working with an independent insurance agent, you can ask them for their opinion of the companies you’re considering.

How To Get Help Comparing Medicare Plans

A great way to get help with your Medicare Plan comparison is to use an independent insurance agent. Whether you’re new to Medicare or comparing your current coverage, an independent agent can be a great asset. Agents can help you compare quotes from multiple insurance companies, and can take the hard work out of looking up doctors and prescription drug formularies. Once you’ve chosen your plan, they can also help you enroll in it, and provide ongoing support.

Related Blog Posts

-

If you are nearing retirement age, you may be wondering what your options are for health insurance. Once you've enrolled…

-

Introduction Healthcare is essential, especially as we get older. We are going to answer the big question, Medicare Supplements vs.…