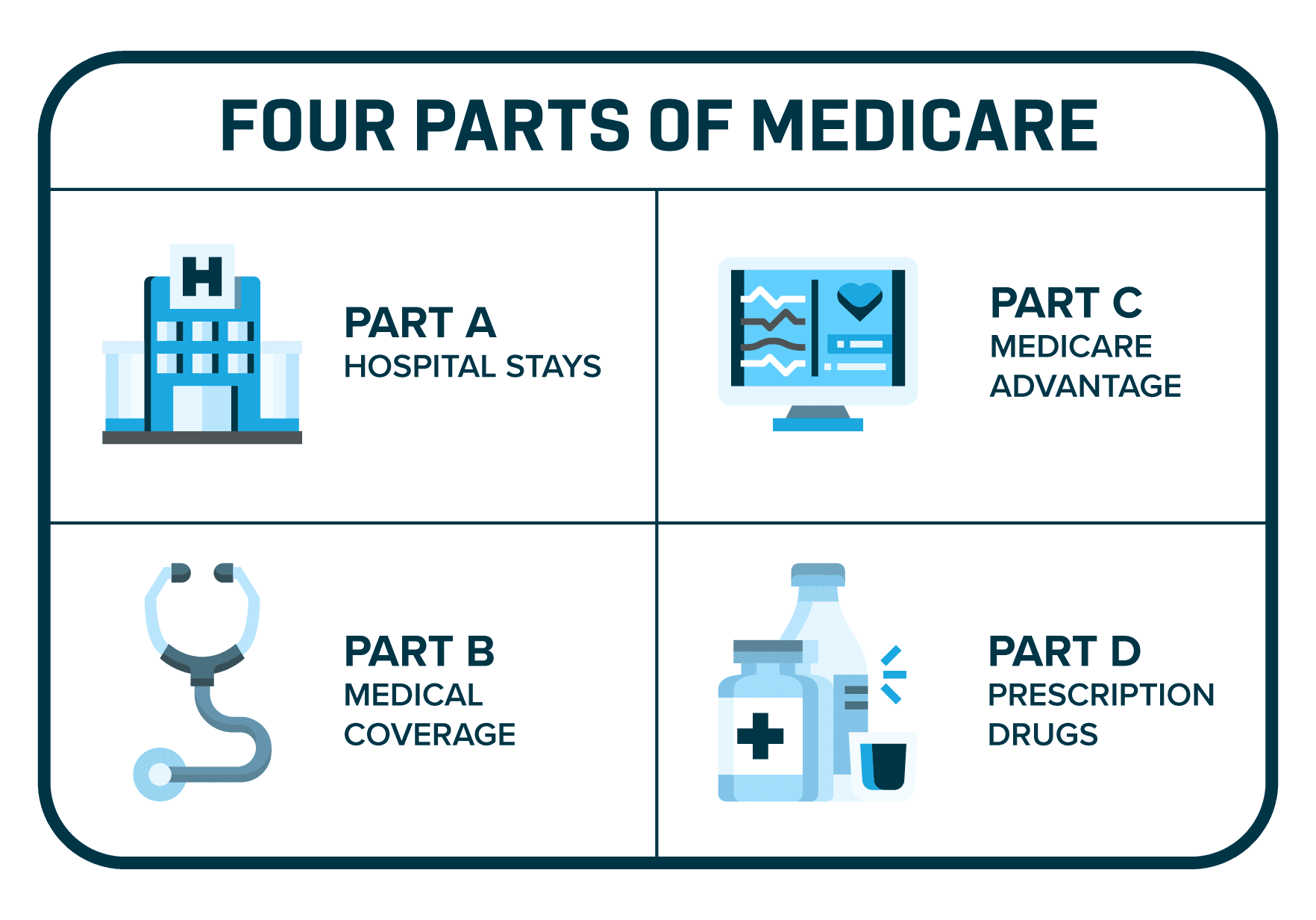

With all the inflation we’ve experienced recently, we’ve seen many of our clients get an increase in their Medicare plans. We often see this during Medicare’s Annual Election Period (AEP) for Medicare Part D and Medicare Advantage plans. But, if you’re enrolled in a Medigap plan, you can see an increase at any time of the year.

Today, we’re going to offer you some advice on what to do if your Medicare premium increases. In many cases, there is something we can do to lower your healthcare costs.

Why Do Medicare Premiums Increase?

First, we should discuss why Medicare premiums change. Medicare premiums are not like car or home insurance; your premium won’t increase if you use the plan. You won’t get “dinged” because you actually used your insurance plan. The premium also will not increase because of your prescriptions.

Part D and Medicare Advantage plans change their premiums each year in January. The change in premium applies to everyone enrolled in that plan, not just you. Instead, the rates change due to the collective costs of all beneficiaries who are enrolled in the plan. Whether you use your plan or not, you’ll be impacted.

Medigap premiums increase for some of the same reasons. However, possibly the biggest reason your Medigap premiums change is your age. Now, there are different kinds of Medigap pricing methods, but the majority of them are structured to increase with age. The thought is that the older we get, the more medical claims we’ll have. Medigap carriers often increase your plan premium each year to keep pace with your age. In addition, they may also increase your premium due to inflation or general healthcare costs.

Part D Premium Increases

Part D plans run on annual contracts. This means they often change their premiums and other plan benefits each year. You may see a premium increase, a change in your deductible, copays, or even a change to the drug formulary (the list of drugs covered by the plan). Sometimes, insurance carriers will even discontinue a plan altogether. When this happens, the carrier will usually automatically move you into a higher premium plan.

Your Part D premium should only change once per year. New premiums go into effect on January 1. You will receive an Annual Notice of Change (ANOC) in September that outlines any changes in your plan for the following year.

Whether your plan is increasing or not, you should take advantage of the Annual Election Period (AEP), which lasts from October 15 through December 7. During this time, you can review your Part D plan and make changes or switch to a new plan.

Medicare Advantage Premiums

Medicare Advantage plans also operate on annual contracts. Like Part D plans, they could change premiums, cost-sharing amounts, provider networks, and covered benefits. Many plans offer zero-dollar premiums, but that’s not always the case. And remember, if the premium increases, it increases for every person enrolled in that plan.

Medicare Advantage plans also send an ANOC in the fall so you can review your benefits. The best way to compare plans is to sit down with an independent insurance agent who can give you an apples-to-apples comparison of every plan in your zip code.

Medigap Premium Calculations

Let’s talk a little more about Medigap premiums. We mentioned that there are three different rating methods insurance carriers use to set your premium. The three methods are issue-age, attained-age, and community rated.

The attained-age rating method is the most common among carriers. Under this method, your premium is largely based on your current age. Age isn’t the only factor carriers use to calculate your premium. It’s also based on your gender, location, and tobacco use. Some carriers may offer discounts for spouses who enroll in the same plan or for paying annually instead of monthly.

Your Medigap premium might not go up exactly on your birthday, but you should expect it to increase once per year. The company will look at its overall costs based on inflation, marketing, and the total amount of claims they paid for all enrollees in your area.

How to Decrease Medicare Plan Premiums

If you notice a significant premium increase in your Medicare plans, you might have options to lower your costs. The process you’ll go through will depend on what type of Medicare plan you have. The team at Bobby Brock Insurance is always looking for ways to save our clients money, so this is an area we are happy to help you with.

Changing Your Part D or Medicare Advantage Plan

In most instances, you can only change your Medicare Part D or Medicare Advantage during the Annual Election Period. However, if you have big life events – like moving to a new state or zip code – you’ll be eligible for a Special Enrollment Period (SEP). During this time, you can change to a new Part D or Medicare Advantage plan.

When changing your plan, you should review the summary of benefits. The key things to look at are the following:

- Premium

- Deductible

- Maximum Out-of-Pocket (MOOP)

- Provider Network

- Copays / Coinsurance

- Drug Formulary

We can’t stress enough how important it is to review your plans during AEP. If you miss an enrollment deadline, you may be stuck with your current plan for the remainder of the year.

Changing Your Medigap Plan

Medigap plan premiums don’t necessarily change on January 1 as Medicare Advantage and Part D plans do. In most cases, they’re increased on the policy’s anniversary date. You should receive a notice from your carrier 30-60 days prior to any premium changes.

A little-known fact about Medigap plans is that you can change your plan at any time of the year. The caveat is that you must be healthy enough to pass medical underwriting. If you have any serious conditions or recent surgeries, you may not be able to change your plan.

Some states have open enrollment periods around your birthday or anniversary, where you can change to the same or lesser-benefit plan without having to go through underwriting. Ask your insurance agent if there are any special opportunities in your state.

If your Medigap premium increases, don’t panic. Call Bobby Brock Insurance. Since we are an independent broker, that means we can shop around at many different insurance companies to find you the most competitive rate.

Related Blog Posts

-

Introduction Healthcare is essential, especially as we get older. We are going to answer the big question, Medicare Supplements vs.…

-

Popular Medicare Supplements in Mississippi - The first question we get asked by new Medicare beneficiaries is, “What’s the best…