The first question we get asked by new clients is, “How much does Medicare cost?” Or similar questions like, “Is Medicare free? What are the Medicare premiums in 2023?” These are all common questions about the cost of Medicare, and we understand why they’re at the forefront of our clients’ minds. Transitioning from an active career to a fixed income is scary, and our clients like to stay ahead of the game.

So, how much does Medicare cost? Unfortunately, no, it’s not free. You’ll pay a premium for Medicare Part B and any other supplemental coverage you want, like Medicare Part D, a Medigap plan, or a Medicare Advantage plan.

The good news is that it’s fairly easy to gather a Medicare cost estimate. Premiums often change from one year to the next, but today, we’ll give you a good idea of what to expect when it comes to Medicare premiums in 2023.

Medicare Part A Premiums in 2023

Most beneficiaries won’t pay a premium for Part A. While you are working and paying taxes, you pre-pay your Medicare Part A premium. So, as long as you (or your spouse) worked 10 years (or 40 quarters) in the United States, you already paid your Part A premium via payroll taxes. In fact, 99% of all Medicare beneficiaries have met this requirement and get to enjoy premium-free Part A.

If you haven’t met that requirement, you will pay a monthly premium for Part A. Your premium will be based on how many quarters you paid taxes. Those who worked at least 30 quarters will owe $278 per month. Those who worked less than 30 quarters will owe the full premium amount of $506 per month. Keep in mind that these are based on 2023 premiums, which often increase each year. In addition, to be eligible to buy Part A, you must be a legal resident of have had a green card for a minimum of five years.

We won’t get into too many details regarding the other costs associated with Medicare, but we also want you to know that you’ll have costs outside of the premium. For example, the 2023 Part A deductible is $1,600. If you have other Medicare plans, like a Medigap plan, this cost might be taken care of by the insurance company.

Medicare Part B Premiums in 2023

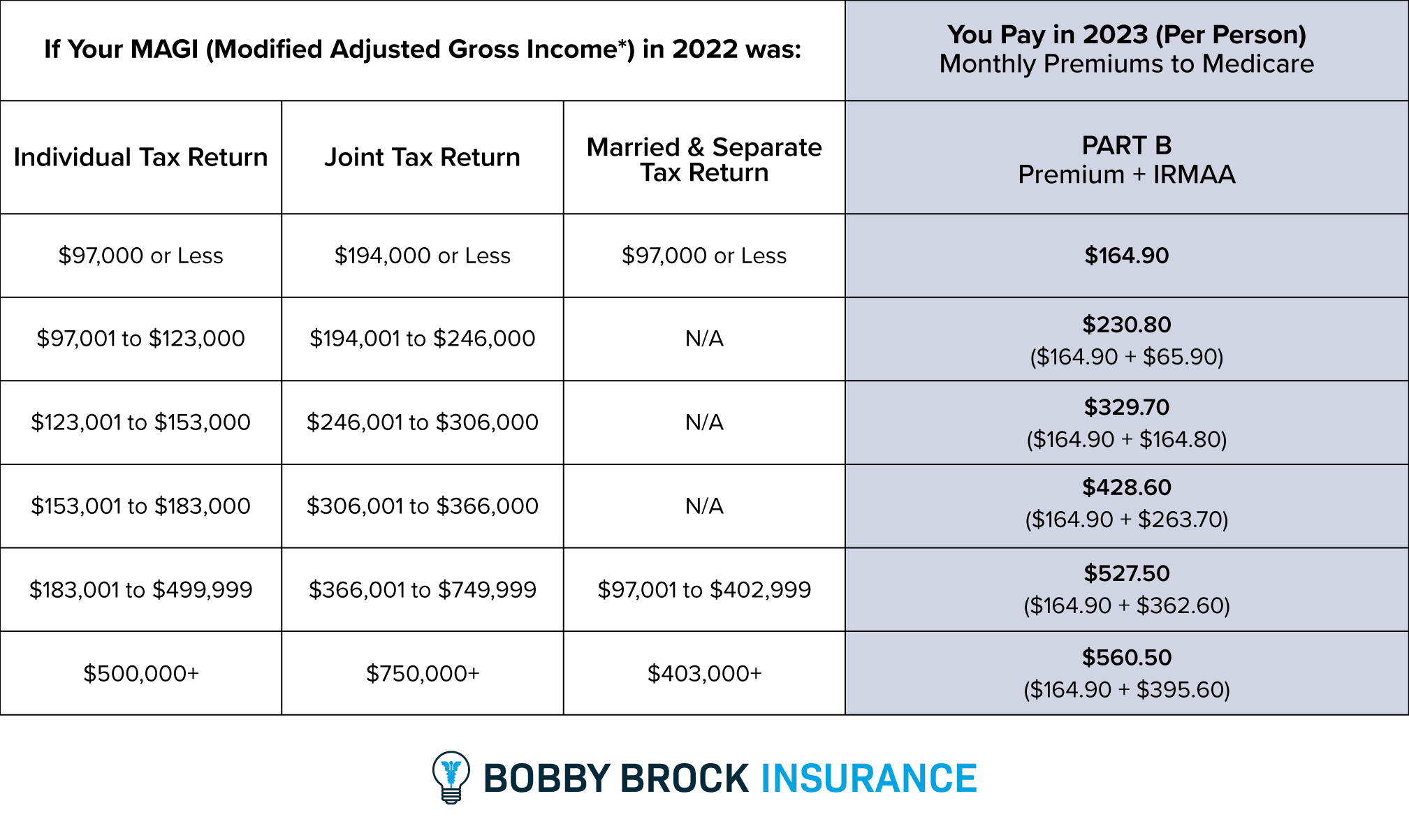

Everyone pays a premium for Medicare Part B unless they qualify for financial assistance through their state’s Medicaid program. The Centers for Medicare and Medicaid Services (CMS) sets a standard Part B premium each year. In 2023, that standard premium is $164.90 per month.

However, some people pay more for Part B. Amounts over and above the standard premium are called IRMAA, the Income-Related Monthly Adjustment Amount. Your cost is based on your modified adjusted gross income (MAGI) for your household. Social Security looks at your tax return from two years prior. They use your MAGI on that return to determine how much you pay for Medicare Parts B and D. (More on Part D in the next section.)

We say “household” income, which typically includes you and your spouse. If you file separately, they’ll look at your MAGI individually, which means if you are married, you may have different Part B premiums. If you file jointly, both of you will pay the same premium.

Your modified adjusted gross income includes all the money you earned through job wages, dividends, interest, and capital gains. It also includes tax-deferred pensions and Social Security benefits. Some income, like Roth IRA or Roth 401(k) distributions, do not count towards your MAGI. The same is true for health savings accounts (HSAs) and reverse mortgages.

Only around 5% of Medicare beneficiaries pay higher rates for Medicare Part B. Keep in mind that your MAGI might change each year, which could impact which of the income thresholds you fall into. We often see new beneficiaries start with higher premiums since they were recently employed. Social Security will send you a letter each December to inform you of your new Part B premium.

Just like Part A, Part B also has out-of-pocket costs. The current annual deductible is $226. Once you’ve met your deductible, Medicare picks up about 80% of all Part B costs.

Medicare Part D Premiums in 2023

The premiums for Parts A and B are pretty straightforward since everyone enrolled in those plans has the exact same coverage. That’s not the case with other Medicare plans, including Part D, Medicare Advantage, and Medigap plans. Even so, we can give you a rough estimate of what you’ll pay for each of those if you choose to enroll.

Part D prescription drug plans are offered by private insurance carriers. Many companies offer Part D plans, and they are different in each zip code. You could have 20 or more plans to choose from based on how much coverage you need.

Typically, people who take specialty medications (or just expensive ones) will need a Part D plan that has more coverage and, therefore, a higher monthly premium. Premiums in most states start around $10 per month but can be well over $100 for more coverage.

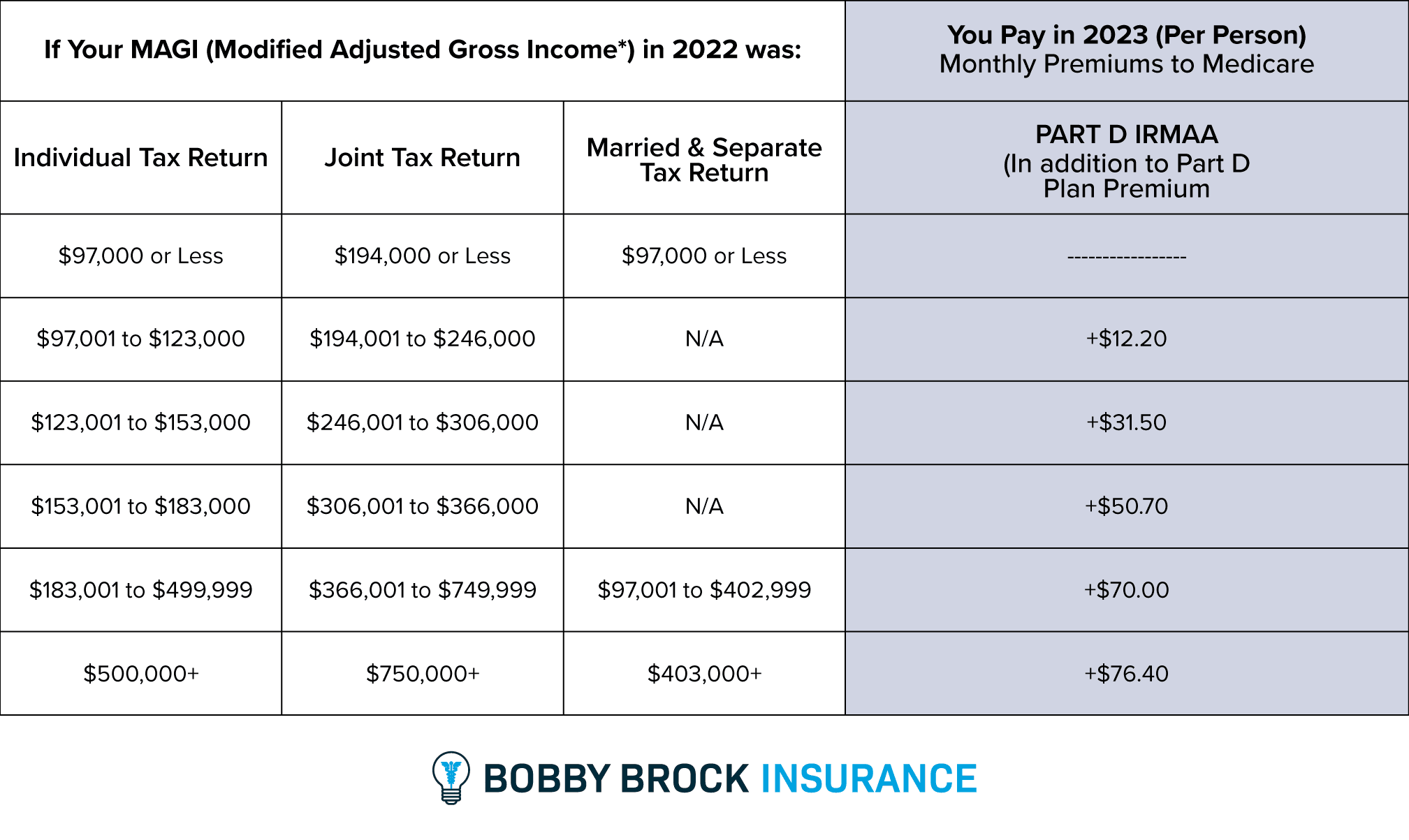

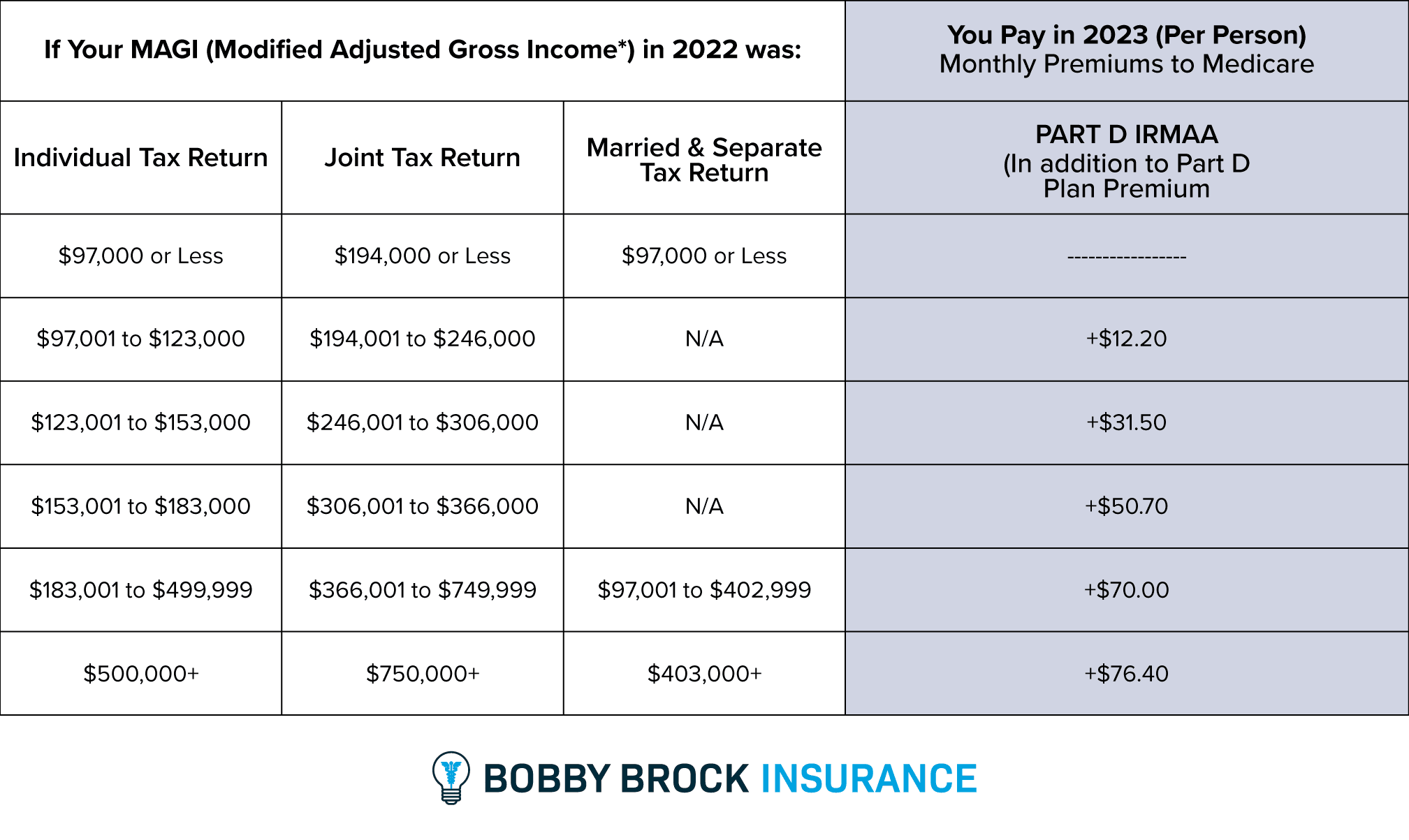

IRMAA also applies to Medicare Part D. If you fall into a higher income bracket, you will pay the plan’s base premium plus the additional IRMAA. The Part D IRMAA amounts are listed in the table below.

In addition to the monthly premium, your Part D plan will have deductible and cost-sharing amounts for your prescription refills. Part D plans can be tricky to estimate because they have several coverage phases. If you take expensive prescriptions, be sure to understand the coverage phases and how the Medicare donut hole could impact your costs.

Medigap Premiums in 2023

To help with some of the out-of-pocket costs left by Parts A and B, many people choose to enroll in a Medigap plan, also known as a Medicare Supplement plan. These plans act as secondary insurance. After a claim runs through Part A or Part B, it’s sent to your Medigap plan for payment. Depending on which Medigap plan you have, you’ll have little to no remaining costs.

The most popular Medigap plans are Plan F, Plan G, and Plan N. Plan F offers the most coverage and also has the highest premiums, followed by Plan G and then Plan N.

Premiums for Medigap plans are not only based on coverage. Personal factors like your age, gender, and zip code also play a significant role in calculating your premium. Older folks pay more than younger ones, men pay more than women, and zip codes with higher costs of living have higher Medigap premiums. To give you an idea, a 65-year-old female with Plan G can expect to pay somewhere around $125 per month.

Medicare Advantage Premiums in 2023

Medicare Advantage, also known as Medicare Part C, is a whole different ballgame. Instead of it acting as a secondary insurance plan, it replaces your coverage under Parts A and B. Technically, you still have Parts A and B, but instead of your claims going to them first, they’ll all route through your Medicare Advantage plan.

Like Part D plans, the costs and benefits of Medicare Advantage plans vary significantly between carriers and regions. There are several different kinds of Medicare Advantage plans, all with different rules and requirements. You should take the time to understand their differences before enrolling.

One of the most attractive things about Part C plans are their low premiums. Most people in the United States have access to at least one Part C plan with a $0 premium. However, you will still be responsible for your Part B premium, as well as any deductibles and cost-sharing amounts within the Medicare Advantage plan.

Medicare Costs: Frequently Asked Questions

How much does Medicare cost each month?

The monthly cost for Medicare depends on which plans you’re enrolled in, as well as your income. For example, if you have Part B and Medigap Plan G, you should expect to pay $164.90 for Part B and around $125 for Plan G. Keep in mind that Medigap plans vary by carrier, and your age has a significant impact on your premium.

In addition, if you have Plan G, you will be responsible for the Part B deductible when you use services. In 2023, that deductible is $226.

How much does Medicare Part B cost?

Most Medicare beneficiaries pay the standard premium for Part B. The premium changes each year but is currently set at $164.90. However, if you earned a higher income, you may pay an additional amount called IRMAA, the Income-Related Monthly Adjustment Amount.

In addition to the monthly premium, Part B has an annual deductible of $226. After you’ve met the deductible, Medicare pays 80% of Part B costs, leaving you to pay the remaining 20% unless you have supplemental coverage in place.

Why do some people pay less for Medicare Part B?

It is possible to pay less than the standard premium for Medicare Part B. Medicare Savings Programs (MSPs) offer several ways to reduce your Part B premiums. MSPs are run by your state’s Medicaid department, so each state will have different eligibility requirements.

If you are eligible for a Medicare Savings Program, you may have your Part B premium paid for, as well as other benefits available to you.

How much money is taken from my Social Security check for Medicare?

Assuming you are eligible for premium-free Part A, the only premium deducted from your Social Security check is the Part B premium. For most people, that amount is $164.90 each month. Individuals or couples who earned higher incomes may be susceptible to IRMAA, which will increase the amount deducted from their benefits.

If you enroll in Medicare Part D, you can choose to have that premium taken from your Social Security check as well. However, you do have the option to pay for Part D with a bank account instead. If you owe IRMAA for Part D, it will be deducted from your Social Security benefits.

How do I pay my Medicare premiums?

If you are receiving Social Security benefits, your Part A and Part B premiums will be deducted from your monthly check. (Most people don’t pay a premium for Part A.) If you are not yet receiving benefits, you’ll be responsible for paying those premiums either online or by mail.

Are Medicare premiums tax-deductible?

Yes! You can deduct Medicare premiums and medical expenses if those costs exceed 10% of your adjusted gross income. Consult a tax professional for guidance to be sure you’re calculating your deductions correctly.

Find Out How Much Medicare Will Cost You!

You don’t have to calculate all these costs yourself. That’s what we’re here for! If your 65th birthday is within the next couple of years, it’s not too early to start planning for Medicare. The advisors at Bobby Brock Insurance will help you understand Medicare and create a custom enrollment timeline. Plus, we’ll review each of your Medicare plan options and go over pros and cons, as well as budget considerations.

Our services are absolutely free. Don’t waste your time trying to figure Medicare out alone – let the experts at Bobby Brock Insurance guide you through the process so you can enjoy your retirement.

Related Blog Posts

-

2022 Medicare premium and cost sharing increase information has been officially released, and the picture is not as pretty as…

-

Currently, the 2021 Medicare Part B premium is $148.50. That is the amount that most people pay for their Part…