Planning for healthcare expenses is an important part of maintaining your financial stability. While you can do much of this planning before your retirement years, you’ll need to continue to stay abreast of significant changes. Each year, Medicare costs are adjusted, and understanding these updates can help you make informed decisions about your healthcare coverage.

The Centers for Medicare and Medicaid Services (CMS) recently announced the 2025 Medicare premiums, deductibles, and other cost updates. Whether you’re enrolled in Original Medicare, exploring Medicare Advantage, or reviewing your prescription drug plan, this guide will help you stay prepared and confident in your coverage choices.

Let’s dive into the specifics of what’s changing and how it might affect you.

Overview of Medicare Parts

Medicare is divided into different parts, each covering specific healthcare services. Here’s a quick look:

- Part A: Covers hospital stays, skilled nursing facility care, hospice, and some home health services. Most people don’t pay a premium for Part A.

- Part B: Includes outpatient care, doctor visits, preventive services, and medical supplies. This part usually requires a monthly premium.

- Part C (Medicare Advantage): An alternative to Original Medicare offered by private companies. These plans often bundle Part A, Part B, and sometimes Part D, along with extra benefits.

- Part D: Provides coverage for prescription drugs. Costs and coverage vary depending on the plan you choose.

- Medigap: Also known as Medicare Supplement Insurance, this helps cover costs not paid by Original Medicare, like deductibles and coinsurance.

Medicare costs, such as premiums, deductibles, and out-of-pocket limits, can change every year based on factors like inflation and healthcare spending. These adjustments affect how much you’ll need to budget for healthcare, from routine checkups to hospital stays. Staying informed helps you avoid surprises and ensures you’re making the most of your Medicare coverage.

2025 Medicare Part A Costs

Medicare Part A is often referred to as hospital insurance because it covers inpatient hospital stays, care in skilled nursing facilities, hospice care, and some home health services. While many people don’t pay a premium for Part A, there are still important costs to consider for 2025.

Premiums

Most Medicare beneficiaries qualify for premium-free Part A through their own or a spouse’s work history, typically requiring at least 40 quarters (10 years) of Medicare-covered employment. However, if you don’t meet this requirement:

- Premium for 30-39 work credits: $285 per month

- Premium for fewer than 30 work credits: $518 per month

Deductibles and Coinsurance

If you require inpatient hospital care, Part A has specific cost-sharing amounts for each benefit period (the 60-day cycle that begins when you are admitted to the hospital):

- Inpatient Hospital Deductible: The 2025 deductible will be $1,676 per benefit period.

- Hospital Coinsurance: After the deductible, you’ll pay:

- $0 for the first 60 days of inpatient care.

- $419 per day for days 61-90.

- $838 per “lifetime reserve day” (up to 60 additional days available over your lifetime).

For skilled nursing facilities, the deductible remains the same, but the coinsurance costs are different:

- The first 20 days are covered in full.

- For days 21-100, you’ll pay a coinsurance of $209.50 per day.

- Beyond 100 days, you are responsible for all costs.

While Part A costs are generally manageable for those with premium-free coverage, deductibles and coinsurance amounts can add up quickly if hospitalization or extended care is required. Reviewing your coverage and considering options like a Medigap plan to cover gaps in Part A costs can be a smart way to protect yourself from unexpected bills.

2025 Medicare Part B Costs

Medicare Part B provides coverage for outpatient services, including doctor visits, preventive care, diagnostic tests, and durable medical equipment. This part typically requires monthly premiums and includes additional out-of-pocket expenses like deductibles and coinsurance. Here’s what’s changing for 2025.

Premiums

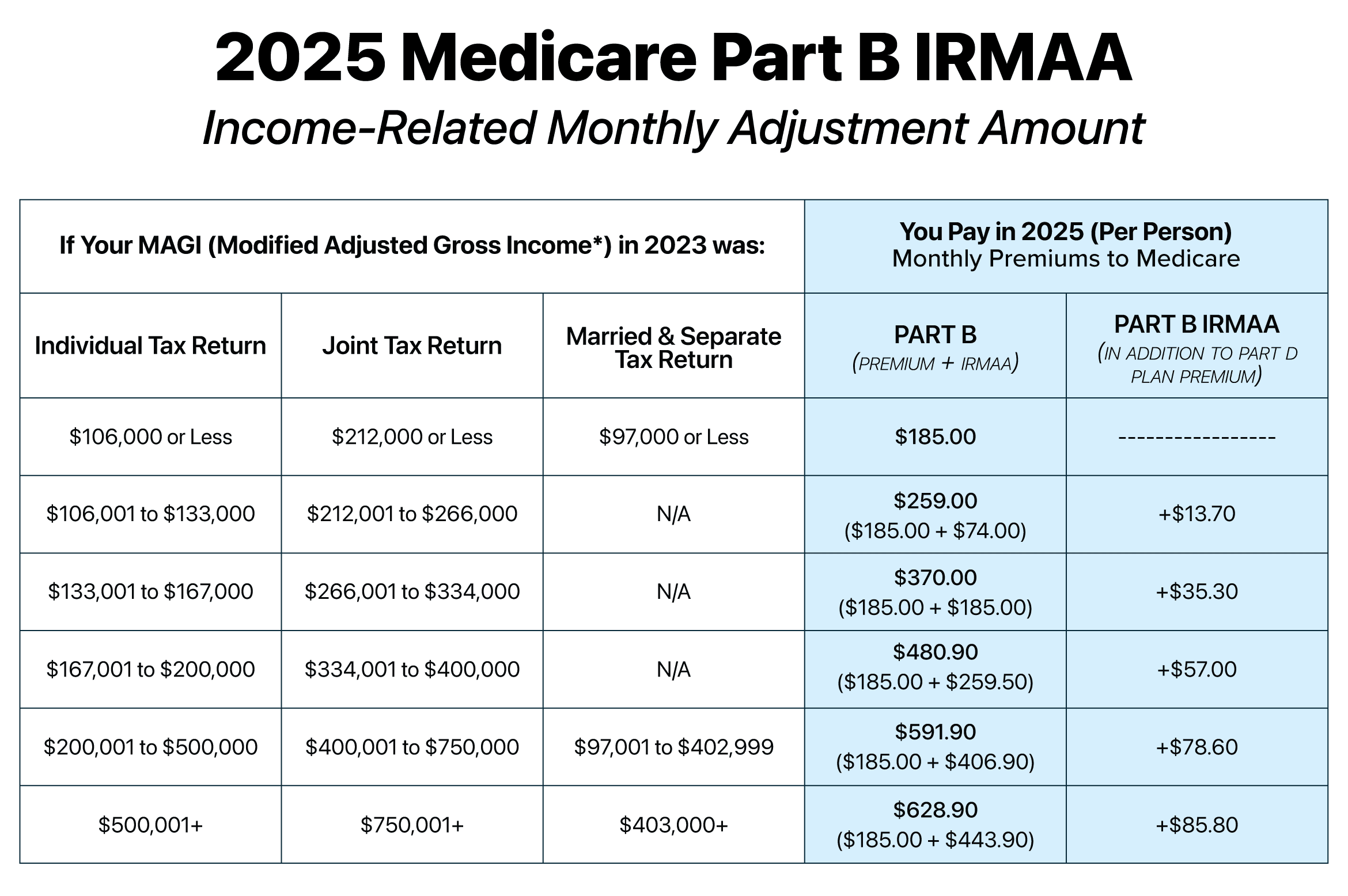

The standard monthly premium for Medicare Part B in 2025 is $185, up from $174.70 in 2024. However, some individuals will pay more due to the Income-Related Monthly Adjustment Amount (IRMAA). IRMAA applies to higher-income beneficiaries, with premiums increasing based on your modified adjusted gross income (MAGI) from two years prior.

For 2025, the premium tiers are as follows:

- Individuals with MAGI up to $106,000 (or married couples up to $212,000): $185.

- Higher-income brackets: Premiums range from $259 to $628.900 depending on income levels.

Deductibles and Coinsurance

The Part B deductible for 2025 is $257, an increase from $240 in 2024. Beneficiaries must meet this deductible before Medicare begins covering most Part B services.

Once the deductible is met, you’ll typically pay 20% of the Medicare-approved amount for most Part B-covered services. Some preventive services are fully covered with no cost-sharing.

The increase in Part B premiums and deductibles may slightly raise healthcare costs for those who use outpatient services frequently. Beneficiaries with higher incomes should also be prepared for the impact of IRMAA on their premiums. To help manage these costs, options like Medicare Advantage plans or state assistance programs may be worth exploring.

2025 IRMAA: What High-Income Earners Need to Know

If you’re a high-income Medicare beneficiary, the Income-Related Monthly Adjustment Amount (IRMAA) will impact the premiums you pay for Medicare Part B and Part D. IRMAA is determined by your modified adjusted gross income (MAGI) from two years prior—in this case, your 2023 tax return will set your 2025 IRMAA tier.

IRMAA Tiers for 2025

For 2025, the IRMAA brackets for Medicare Part B and Part D premiums are as follows:

- MAGI up to $106,000 (individual) or $212,000 (married filing jointly): No IRMAA, standard Part B premium of $185 per month.

- MAGI $106,001–$131,000 (individual) or $212,001–$262,000 (married): Part B premium of $259 per month, with an additional $13.70 for Part D.

- MAGI $131,001–$165,000 (individual) or $262,001–$329,000 (married): Part B premium of $389 per month, with an additional $34.20 for Part D.

- MAGI $165,001–$499,999 (individual) or $329,001–$749,999 (married): Part B premium of $514 per month, with an additional $85.80 for Part D.

- MAGI $500,000+ (individual) or $750,000+ (married): Part B premium of $628.90 per month, with an additional $85.80 for Part D.

How IRMAA Affects Your Budget

IRMAA can significantly increase your Medicare costs, especially if your income is close to the next tier. Planning ahead is essential to avoid unexpected premium hikes. For example:

- A single filer with MAGI of $165,001 will pay an additional $329 per month for Part B compared to someone just below the threshold.

- If your income decreases significantly in 2023 due to retirement or other changes, you can appeal IRMAA by filing Form SSA-44 to request a new determination.

Tips to Manage IRMAA Costs

- Adjust Your MAGI: Consider contributing to a Health Savings Account (HSA) or other tax-advantaged accounts to lower your taxable income.

- Appeal When Necessary: If your income changes due to a qualifying life event (e.g., retirement, divorce, or loss of income), appeal your IRMAA determination.

- Review Investments: Capital gains from selling assets can push you into a higher IRMAA tier. Plan asset sales strategically.

- Work with a Financial Advisor: A professional can help you develop a tax strategy to minimize IRMAA exposure.

2025 Medicare Advantage Updates

Medicare Advantage plans, or Part C, are private insurance plans that provide an alternative to Original Medicare. These plans often combine coverage for Part A, Part B, and sometimes Part D (prescription drugs), along with additional benefits like vision, dental, and hearing care. While costs for these plans vary widely, here are some trends and updates for 2025.

Premiums and Out-of-Pocket Limits

- Premiums: The average monthly premium for Medicare Advantage plans is expected to be around $17, continuing a trend of affordability compared to Original Medicare. Many plans still offer $0-premium options, though these may have higher out-of-pocket costs.

- Out-of-Pocket Maximums: In 2025, the median out-of-pocket limit for in-network services under Medicare Advantage plans will be $5,400, with some plans offering lower limits. If the plan includes Part D, the prescription costs will be capped at $2,000.

Additional Benefits

One of the key advantages of Medicare Advantage is the range of extra benefits, which often include:

- Vision care, such as eye exams and glasses.

- Dental services, including cleanings, fillings, and sometimes dentures.

- Hearing aids and hearing exams.

- Wellness programs, such as gym memberships or health coaching.

Due to the Inflation Reduction Act, many of the extra benefits are undergoing changes in 2025. It’s important to review your plan annually during the Annual Election Period to stay informed about these changes.

2025 Medicare Part D Prescription Drug Coverage Updates

Medicare Part D helps cover the cost of prescription medications and is available as a standalone plan or bundled within a Medicare Advantage plan. In 2025, beneficiaries will see several updates to Part D costs and coverage, including changes driven by federal policies aimed at making medications more affordable.

Premiums

The average monthly premium for Part D plans is expected to be around $45 in 2025. However, premiums can vary depending on the specific plan and region. Beneficiaries should compare plans to find the best balance between premiums and coverage for their medications.

As with Medicare Part B, IRMAA applies to Part D plans as well. Depending on your income, IRMAA can range from $13.70 to $85.80 per month.

Annual Deductibles

The maximum deductible for Part D plans in 2025 will increase to $590. Some plans may waive the deductible for certain drug tiers, like generics.

Catastrophic Coverage Threshold

One of the most significant changes in 2025 is the elimination of out-of-pocket costs in the catastrophic coverage phase. Previously, beneficiaries were responsible for a small percentage of drug costs even after reaching this phase. Under the new rule, beneficiaries will no longer pay out-of-pocket costs for medications once they hit the maximum out-of-pocket of $2,000.

Inflation Reduction Act Provisions

The Inflation Reduction Act continues to bring impactful changes to Medicare Part D, including:

- Insulin Price Cap: Insulin costs are capped at $35 per month, with no deductible.

- Expanded Drug Price Negotiations: Medicare is negotiating prices for more high-cost medications, which may lead to reduced costs for certain drugs.

- Vaccine Coverage: Part D plans will fully cover recommended vaccines without any cost-sharing.

The updates to Part D for 2025 are designed to provide relief for those managing high drug costs, especially with the removal of catastrophic coverage out-of-pocket expenses. Beneficiaries should still review their plan’s formulary to confirm that their medications are covered at the lowest possible cost.

Factors Influencing Medicare Costs

Medicare costs, including premiums, deductibles, and coinsurance, are not static—they are influenced by various factors each year. Understanding what drives these changes can provide insight into why you might be paying more for coverage in 2025.

1. Healthcare Inflation

The rising cost of healthcare services, such as hospital care, doctor visits, and prescription medications, plays a significant role in determining Medicare expenses. Advances in medical technology and higher demand for healthcare services can also contribute to these increases.

2. Demographic Shifts

As the population ages, more individuals are enrolling in Medicare. This growing number of beneficiaries can increase overall program costs, which are then reflected in premiums and other expenses.

3. Federal Budget and Legislation

Medicare is funded through a combination of payroll taxes, beneficiary premiums, and general tax revenue. Changes in federal funding allocations or new legislation can directly impact program costs. For example, the Inflation Reduction Act introduced measures aimed at reducing prescription drug prices, which could help stabilize Part D costs over time. Adjustments to Social Security and tax policies also influence Medicare premiums and subsidies.

4. Utilization Trends

The overall use of Medicare-covered services, such as hospital admissions or outpatient procedures, affects program spending. When utilization rates increase, costs may rise to accommodate the demand.

What These Changes Mean for You

The updates to Medicare for 2025 may bring both opportunities and challenges. Understanding these changes will help you make informed decisions about your healthcare coverage and budget.

For many beneficiaries, the increase in Medicare Part B premiums and the Part A deductible could mean higher monthly costs. However, if you’re enrolled in a Medicare Advantage plan, the premium increases may be less significant. On the other hand, the removal of out-of-pocket costs during the catastrophic coverage phase for Part D prescriptions provides a major benefit for those with high medication expenses.

In general, these changes reflect the rising cost of healthcare services, but there are still ways to minimize the financial burden. By staying informed about the changes to your coverage and reviewing your options, you can find the best combination of benefits and affordability.

One of the most important steps you can take is to review your Medicare coverage each year. During the Annual Enrollment Period (October 15–December 7), you can make changes to your coverage. This is the perfect time to:

- Compare Part D and Medicare Advantage plans to see if any new plans or coverage options better suit your needs.

- Evaluate your healthcare usage to determine if a Medigap plan might offer more comprehensive coverage to help manage out-of-pocket costs.

- Switch plans if needed: If you’re facing increased costs with your current plan, consider alternative options that might offer lower premiums or additional benefits.

Given the rising costs of healthcare, it’s important to set aside a portion of your budget for Medicare-related expenses. Be sure to factor in premiums, deductibles, coinsurance, and any out-of-pocket costs for services like hospital stays or medications. By anticipating these costs, you’ll be better prepared for the year ahead.

If the cost increases are a concern, there are assistance programs available that can help reduce your out-of-pocket costs.

- Medicare Savings Programs can help cover premiums, deductibles, and coinsurance for those who qualify based on income.

- Extra Help can assist with costs for Part D prescription drugs, particularly for those with limited income.

If you’re unsure whether you qualify for these programs, we can help guide you through the eligibility requirements.

Bobby Brock Insurance Keeps You Informed

At Bobby Brock Insurance, we specialize in helping individuals navigate the complexities of Medicare. We understand the challenges that come with managing healthcare costs, and we are here to assist you in finding the right coverage at the best possible price. Our team is ready to help you.

We offer free consultations to discuss your specific situation and ensure you’re getting the most out of your Medicare coverage.

Related Blog Posts

-

Earlier this month, the Centers for Medicare and Medicaid Services (CMS) released updates for the 2024 Medicare premiums, deductible, and…

-

The first question we get asked by new clients is, “How much does Medicare cost?” Or similar questions like, “Is…