Medicare, as a health insurance program, is very popular with Americans. It helps people pay for their health care costs, and the premiums are quite affordable for most people. Especially for people who have to pay for health insurance in their 60s, Medicare is a bargain. It is for these reasons that the program is so popular. However, the same cannot be said about the drug portion of Medicare – Part D. Though people were excited to have drug coverage, and although it really does help them save money on most prescriptions, they don’t view it favorably.

A big reason for this lies in the fact that there is no out of pocket cap on drug spending. This is much different from the medical side of things, especially when looking at the private Medicare plans like Medicare Supplement Insurance or Medicare Advantage. Both of these programs cap out of pocket spending on medical services and procedures. Not so with drug costs. Even with the advent of Part D drug plans, there is no limit to how much you could spend on prescriptions. The biggest illustration of this fact is the Medicare donut hole, a controversial aspect of the Part D program. In this article, we’ll look at the history of the donut hole and some of the details of Part D plans.

What Are Part D Prescription Drug Plans?

Part D of Medicare became effective in 2006. This program provided a way to get help with prescription drugs for the first time. Part D sets out two ways to get coverage:

- From standalone Prescription Drug Plans, and

- Medicare Advantage Prescription Drug Plans (MAPD)

You have to choose between them – you can’t have both at the same time. While your medical coverage will work differently depending on what type of drug plan you choose, the way your drug coverage works is the same either way. For the rest of the article, we’ll review how drug coverage works, regardless of what type of plan you choose.

How Do Medicare Part D Plans Work?

Like with everything else related to Medicare, no part of this program is free. There are a variety of costs that you can encounter, including:

- Monthly premiums for coverage

- Annual deductibles

- Per-prescription co-payments or co-insurance

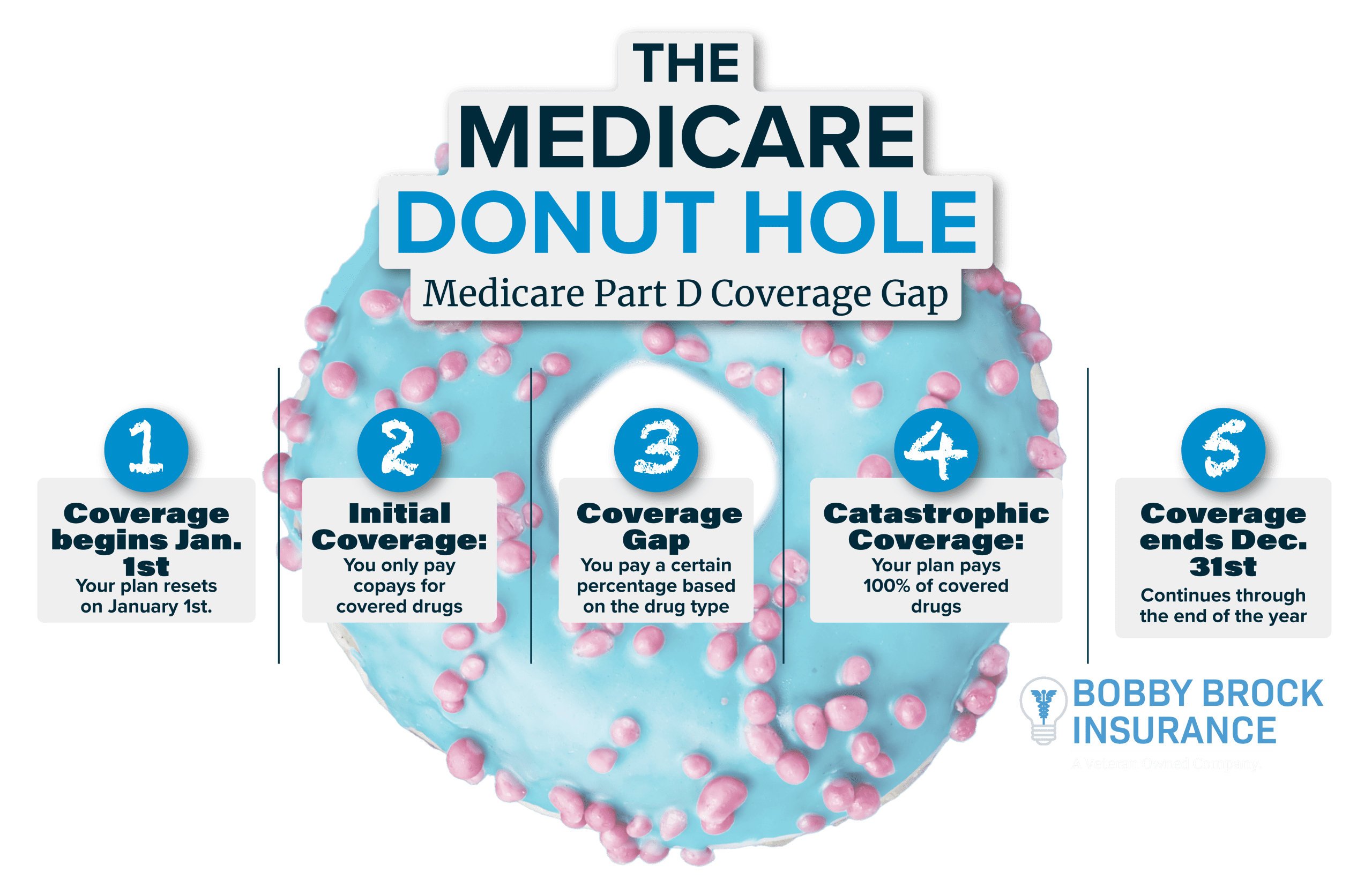

The idea behind the program is to help you pay for your medications; it is not designed to pay for every dollar of every prescription. Your costs for prescription drugs will change during the course of the year as you move through four “Coverage Stages.” You move through these stages based on how much you and your insurance company have paid for covered medications during the year.

Coverage Stage 1 – Deductible Stage

The first stage is the deductible stage. If your plan has a deductible, you must meet this amount before your plan will begin paying for medications. Maximum deductibles are set by Medicare each year, and have historically been less than $500. As soon as you meet your deductible, you move to the second coverage stage.

Coverage Stage 2 – Initial Coverage Stage

In this stage, you will pay a set co-payment or co-insurance for your prescription drug fills. These costs are spelled out in your plan documents. Your drug plan insurance company pays the rest of the cost for your medications. When total drug spending – what you have paid for them PLUS what your drug plan has paid – exceeds $4,430 (2022 amount), you move to the third coverage stage.

Coverage Stage 3 –Coverage Gap

This is the problematic part of the prescription drug program. This is actually where the term Medicare donut hole came from. The official name for this stage is “Coverage Gap” because there’s literally a gap in your coverage. In this stage, your share of costs rises to a fixed 25% for both generic and brand name drugs. However, your insurance company’s share of costs drops drastically:

- They pay 0% for generic medications during this stage, and

- They pay 5% for name brand drugs during Stage 3

In the past, you had to pay the full cost of medications during this coverage stage. However, this donut hole has been closing since 2011. The Affordable Care Act (ACA) called for the end of the donut hole over a series of years. The Medicare donut hole officially closed for the 2020 plan year. You may wonder how the mediations are paid for if you’re only paying 25% and your plan is paying no more than 5%. The answer is different for generic medications and name brand ones.

For generic medications, Medicare pays the difference; 75%. For brand name drugs, the manufacturer is required to provide a 70% discount. So, for brand name medications in the third coverage stage, total drug costs are paid as follows:

- 5% by your plan

- 70% by drug maker discounts

- 25% by you

You continue to pay 25% of the cost of your prescriptions until your total drug costs exceed $7,050 (2022 amount). Once this spending threshold is reached, you move to the fourth and final coverage stage. It’s important to understand what costs go into this number ($7,050). All of these costs count towards the threshold:

- Your out of pocket costs for prescription drug fills

- The value of manufacturer discounts on your brand name drugs in the coverage gap (even though this isn’t an “out-of-pocket” expense for you)

Since 70% (the discount provided by the drug makers) of the cost for name brand medications tends to be a high number, you can see that you will move out of the coverage gap (Medicare donut hole) quickly.

Coverage Stage 4 – Catastrophic Stage

In the catastrophic coverage stage, your costs are strictly limited. You’ll pay no more than a very nominal co-payment or 5% of drug cost. You remain in this coverage stage until the calendar year ends. You start over again at Stage 1 on January 1st of each year.

Tips To Help In The Medicare Donut Hole

No one wants to be in the donut hole, but getting out of it as soon as possible will ultimately help you save money. Here are some quick tips to make sure you move to the catastrophic coverage stage as quickly as possible:

- Run every prescription through your drug plan (don’t pay cash for them); otherwise, you don’t get “credit” for the money you spend and you’ll stay in the donut hole longer.

- Try to get 90 day supplies if you’re close to the threshold amount

- Only use medications on the formulary – use an alternative medication if you can safely do so in order to make sure that your drug costs count towards your threshold amount.

Part D of Medicare is the most complicated aspect to the entire Medicare program. However, it is a very important part of your health care. Always make sure that any Part D plan you’re considering covers all of the medications you take. If you want help reviewing your medications or comparing Part D plans, reach out to a licensed health insurance agent today. Schedule a free consultation to compare quotes for plans in your area.

Related Blog Posts

-

If you take prescription medications, you are probably very familiar with Medicare's Donut Hole. While you may be familiar with…

-

Medicare in Mississippi - Medicare is a federal government program that provides health insurance to people who are 65 and…