If you take prescription medications, you are probably very familiar with Medicare’s Donut Hole. While you may be familiar with it, the Donut Hole is still very confusing and many of our clients have questions about how it works.

In this article, we’re going to discuss what the Donut Hole is, how your coverage is affected by it, and how to avoid it.

What is the Donut Hole?

The Donut Hole is also referred to as the Coverage Gap and it is part of every Medicare Part D plan, including those that are part of a Medicare Advantage plan. After you and your insurance company has spend a certain about of medications, you enter the coverage gap. When you enter the coverage gap, you will pay more for your prescription medications.

But why does the Donut Hole even exist?

The initial reason behind the Donut Hole was to get Medicare beneficiaries to use generic medications instead of name-brand ones. The thought was that doing so would save both the individual and the insurance company a significant amount of money each year.

There have been changes in the coverage gap over time. Initially, individuals had to pay 100% of the cost of their prescriptions when they were in the coverage gap. Now, that amount is limited to 25% for generic and name-brand medications.

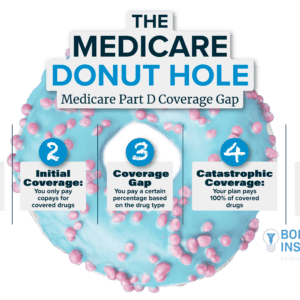

Prescription Coverage Phases

Prescription drug plans work in a unique way. There are actually four phases of coverage in every Part D prescription drug plan.

Phase 1: The Deductible

Some prescription drug plans have an annual deductible. You will need to meet this deductible before your insurance coverage begins. However, most insurance plans do not apply the deductible to tier one medications, which typically includes the more common, generic prescriptions. In 2021, all deductibles were limited to a maximum of $445.

Phase 2: Initial Coverage

Your initial coverage will begin after you have met your deductible, if you have one. You will pay any copayments or coinsurance costs during this phase. For example, if your plan as a 20% copayment for a prescription that costs $100, you will pay $20 and your plan would be the remaining $80.

Phase 3: The Donut Hole / Coverage Gap

Once you and your insurance company have spent a total of $4130, you will enter the donut hole. (This number can change each year.) Your deductible, copays, and coinsurance costs all count towards this number. However, your plan’s premium, pharmacy dispensing fees, or your expenses for prescriptions that were not covered by your plan do not count towards that amount.

While you are in the coverage gap, you may pay up to 25% of the cost of your medications. The coverage gap does not apply to individuals who receive Extra Help.

Phase 4: Catastrophic Coverage

Once you have spent $6550 out of your own pocket, catastrophic coverage begins. (Again, this number is for 2021 and is susceptible to changes each year.)

During the catastrophic phase, you will only pay a small copayment or coinsurance amount for your prescription medications. You stay in this phase for the remainder of the year.

How to Avoid the Medicare Donut Hole

If you are taking expensive prescriptions, or are on a higher number of medications, sometimes there is just no avoiding the coverage gap. However, there are a few things you can try to avoid the coverage gap for as long as possible.

Try Switching to Generic Prescriptions

If you are taking a name-brand medication, speak to your provider or pharmacist about switching to a generic alternative. The FDA requires that all generic medications must have the same ingredients and effect as their name-brand counterparts, so switching to generic may be a great option for you.

Use a Preferred Pharmacy or Order Online

Part D plans have relationships with pharmacies. Your plan will cover more if you have your medications filled at a preferred pharmacy than they would if you went to a standard pharmacy. You may need to switch pharmacies in order for your insurance plan to pay for more of the expenses.

And remember, your Part D plan will change each year, including which pharmacies they work with.

You may even find that you have more coverage if you order your medications online. Sometimes there are discounts given if you order a 3-month supply of your prescriptions. If that’s the case, you should also ask your local pharmacy if they could give you a discount for picking up your medication every three months instead of every month.

Ask for Manufacturer’s Discounts

There are some pharmaceutical companies that will give discounts or coupons if you simply call and ask them! This is especially common for specialty and name-brand medications, which are generally associated with a higher cost.

Ask your doctor about these discounts or go to the manufacturer’s website.

Apply for Extra Help

We mentioned the Extra Help program earlier. Extra Help is a low-income subsidy program that offers financial assistance for prescription drugs. There are qualifications individuals must meet in order to be eligible for the program.

Some states offer other financial assistance programs that come with their own set of qualifications. Contact one of our agents or the Social Security Administration to see if you qualify.

Switch Part D Plans

Finally, regardless if you’ve ever found yourself in the coverage gap or not, you should always look at new plans during the Annual Enrollment Period.

AEP occurs each fall from October 15 to December 7. During this time, you can compare your current coverage to other plans on the market and decide if you’d like to switch plans in the upcoming year.

We hope that has helped clear up some of the confusion around Medicare’s donut hole. If you find yourself in the coverage gap, give one of our agents a call so we can help you navigate this phase and look into other options for coverage.

Related Blog Posts

-

Medicare, as a health insurance program, is very popular with Americans. It helps people pay for their health care costs,…

-

For most people, their Medicare enrollment process will begin three months before they turn 65, which marks the beginning of…