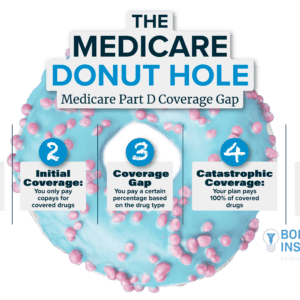

The Part D Donut Hole refers to the hole consumers find themselves in when they reach a certain threshold and are then required to pay more out-of-pocket. The Part D Donut Hole is the same as the coverage gap. To figure out why it’s called the Donut Hole and what happens when you get out of it, read on.

What the Donut Hole Is

The Part D donut hole refers to the coverage gap between $4,130 and $6,550. First, imagine that at the beginning of the year, you and the insurance carrier are starting at 0$ in prescription costs. As the year goes on, both you and the carrier pay for prescriptions every month based on your health needs. You are covered and are therefore paying relatively little out-of-pocket. However, your insurance carrier is still paying. Once both you and the insurer collectively pay $4,130 in total, your coverage gap begins and you are now in the donut hole. In the donut hole, you are required to pay 25% of the cost of the medication whereas before you were only required to pay a small copay. This coverage gap drastically increases your out-of-pocket expenses. You are in the coverage gap until both you and the insurer pay $6,550 for the year. You are then out of the hole.

What Happens After You Get Out

Once you are out of the donut hole, you enter a phase called catastrophic coverage. While this sounds dramatic, in actuality you are paying less than you were while in the hole. With catastrophic coverage, you are only required to pay 5% of the cost of the drug.

How to Avoid the Hole

Many people have multiple medications. Paying 25% for each medication can become quite pricey. Therefore, many people want to know how to avoid falling into the donut hole in the first place. The best way to avoid the coverage gap is to keep your initial costs low for both you and the insurance company. First, you should choose generic options when you can. Next, you should buy your medications through the mail and in advance. Lastly, you should choose Medicare Part D plans that cover your prescriptions and have better deals with pharmacies and manufacturers.

It is not impossible to avoid the donut hole, but it does take some planning. To learn more about Part D, contact us today.

Related Blog Posts

-

If you take prescription medications, you are probably very familiar with Medicare's Donut Hole. While you may be familiar with…

-

Medicare, as a health insurance program, is very popular with Americans. It helps people pay for their health care costs,…